Among the main problems of the Russian economy, many economists highlight the shortage of funds at enterprises for their current, financial and investment activities. Upon closer examination of this problem, it turns out that one of the reasons for this deficit is, as a rule, the low efficiency of attracting and using monetary resources, the limited use of financial instruments, technologies and mechanisms.

The rational formation of cash flows contributes to the rhythm of the operating cycle of the enterprise and ensures the growth of production volumes and product sales. At the same time, any violation of payment discipline negatively affects the formation of production stocks of raw materials and materials, the level of labor productivity, sales of finished products, the position of the enterprise on the market, etc. Even for enterprises that successfully operate in the market and generate a sufficient amount of profit, insolvency can arise as a result of the imbalance of various types of cash flows over time.

Assessment of the company's cash flows for the reporting period, as well as planning cash flows for the future, is an important addition to the analysis of the company's financial condition and performs the following tasks:

Determination of the volume and sources of funds received by the enterprise;

Identification of the main areas of use of funds;

Assessment of the adequacy of the company's own funds for investment activities;

Determination of the reasons for the discrepancy between the amount of profit received and the actual availability of funds.

Cash flow management is an important factor in accelerating the turnover of a company's capital. This is due to a reduction in the duration of the operating cycle, a more economical use of its own and a decrease in the need for borrowed funds. Consequently, the efficiency of the enterprise depends entirely on the organization of the cash flow management system. This system is created to ensure the implementation of short-term and strategic plans of the enterprise, preservation of solvency and financial stability, more rational use of its assets and sources of funding, as well as minimizing the cost of financing economic activities.

The purpose of this work is to define the concept of cash flow, its classification and identification of the principles of cash flow management, disclosure of the concept of cash flow analysis and methods for assessing their assessment.

The final chapter is devoted to the issue of cash flow optimization, as one of the most important and difficult stages of enterprise cash flow management.

Chapter I. Theoretical foundations of cash flow management

The cash flow of an enterprise is a set of distributed over time receipts and payments of cash generated by its economic activity.

In domestic and foreign sources, this category is interpreted in different ways. So, according to the American scientist L.A. Bernstein, "the term" cash flows "(in its literal meaning), which has no appropriate interpretation, is meaningless in itself." The company may experience cash inflows (there are cash receipts), and it may experience cash outflows (there are cash payments). Moreover, these cash inflows and outflows can relate to different types of activities - production, finance or investment. You can define the difference between cash inflows and outflows for each of these activities, as well as for all activities of the enterprise in the aggregate. These differences are best attributed to net cash inflows or net cash outflows. Thus, the net cash inflow will correspond to the increase in cash balances for the period, while the net outflow will be associated with a decrease in cash balances during the reporting period. Most authors, when referring to cash flows, mean cash generated as a result of economic activity.

Another American scientist J. K. Van Horn believes that "the cash flow of a firm is a continuous process." A firm's assets represent the net use of cash, and liabilities represent net sources. Cash flow fluctuates over time depending on sales, collection of receivables, capital expenditures and funding.

In the West, scholars interpret this category as "Cash-Flow" (cash flow). In their opinion, Cash-Flow is equal to the sum of the annual surplus, depreciation deductions and contributions to the pension fund.

Often, planned dividend payments are deducted from Cash-Flow in order to move from possible volumes of internal financing to actual ones. Depreciation charges and pension fund contributions reduce domestic funding opportunities, although they occur without a corresponding cash outflow. In fact, these funds are at the disposal of the enterprise and can be used for financing. Consequently, Cash-Flow can be many times the annual surplus. Cash-Flow reflects the actual volume of domestic funding. With the help of Cash-Flow, an enterprise can determine its current and future capital needs.

In the activity of any enterprise, the availability of funds and their movement is extremely important. No enterprise can carry out its activities without cash flows: on the one hand, for the production of products or the provision of services, it is necessary to purchase raw materials, materials, hire workers, etc., and this causes the outflow of funds, on the other hand, for the products sold or the services rendered are received by the enterprise. In addition, the company needs funds to pay taxes to the budget, pay general and administrative expenses, pay dividends to its shareholders, to replenish or renew the equipment fleet, and so on. Cash flow management includes calculating the financial cycle (in days), analyzing cash flow, forecasting it, determining the optimal level of cash, drawing up cash budgets, etc. The importance of this type of asset as cash, according to D. Keynes, is determined by three main reasons:

· routine - funds are used to carry out current operations; since there is always a time lag between incoming and outgoing cash flows, the company is forced to constantly keep free funds in the current account;

· precaution - the activities of the enterprise are not strictly predetermined, therefore, funds are needed for unforeseen payments;

· speculativeness - funds are needed for speculative reasons, since there is always a possibility that a profitable investment opportunity will suddenly appear.

The concept of "cash flow of the enterprise" is aggregated, which includes numerous types of these flows serving economic activities. In order to ensure effective targeted management of cash flows, they require a certain classification.

Let's consider the most common classifications of cash flows.

1. By the scale of servicing the economic process, the following types of cash flows are distinguished:

- cash flow throughout the enterprise as a whole. This is the most aggregated type of cash flow that accumulates all types of cash flows serving the business process of the enterprise as a whole;

- cash flow for individual structural divisions (responsibility centers) of the enterprise. This differentiation of the cash flow of the enterprise defines it as an independent object of management in the system of organizational and economic structure of the enterprise;

- cash flow for individual business transactions. In the system of the economic process of the enterprise, this type of cash flow should be considered as the primary object of independent management.

2.By types of economic activities in accordance with the international accounting standard, the following types of cash flows are distinguished:

- cash flows from operating activities.

Main directions of cash inflow and outflow from core business

- cash flows from investment activities.

- Why is a profit and loss account bad

- How Cash Flow Budget Helps the CEO

- What the cash flow budget includes

- What data should budgets for short and long term be based on?

- How to predict cash inflow and outflow

The financial and economic activities of the company can be expressed through cash flow, which includes income and expenses. Choosing a cash investment decision is the most important stage in the work of every firm. In order to successfully use the funds raised and extract the greatest return on invested capital, you should carefully analyze future cash flows related to the implementation of the transactions performed, the agreed forecasts and projects.

It is believed that the most complete assessment of the company's performance is provided by the profit and loss statement. However, he does not meet the needs of the head of the enterprise: after all, this report is compiled on an accrual basis - expenses are recorded in it only after writing off to, and not when they need to be carried out. This means that even a perfectly prepared report will reflect not the payments that the company made or intends to make, but the conditional economic results. To get a clear picture of the organization's financial performance before your eyes, you need reporting:

- demonstrating how the company is secured with cash at any given time;

- free from any influence of legal and accounting requirements (that is, intended only for the head of the enterprise);

- covering, if possible, all aspects of the company.

Best of all, these conditions are matched by the cash flow budget (or cash flow).

The cash flow budget is a table that reflects the receipts and expenditures of the company's cash. It can be drawn up for any period - from several weeks to several years. There are two common methods of preparing this document: direct and indirect. Using the direct method, operating cash flows are allocated to income and expense items (for example, sales receipts, salaries, taxes). The indirect method assumes that operating flows are determined based on net income adjusted for depreciation and changes in working capital.

In some cases it is easier to use the indirect method, but the budget drawn up with its use is inconvenient for analysis. Therefore, cash flow is almost always calculated using the direct method.

- Optimizing the capital structure of an organization: how not to lose balance

What does cash flow management give

Successful management of enterprise cash flows:

- must ensure compliance with the financial balance of the company at every stage of its development. Growth rates and financial stability primarily depend on the extent to which cash flow options are synchronized in their volumes and in time. A high degree of such synchronization makes it possible to significantly accelerate the implementation of the company's strategic development objectives;

- helps to reduce the firm's need for credit resources. Due to active management of financial flows, it is possible to achieve more optimal and economical spending of its funds, to reduce the company's dependence on attracting credit resources;

- helps to reduce the risk of insolvency.

Types of cash flows

The main cash flows of an enterprise are usually grouped according to 8 main characteristics:

By the scale of service of the economic process:

- by the company in general;

- for each separate separate subdivision;

- on various economic transactions.

By type of economic activity:

- operating cash flows (production, core business);

- investment;

- financial.

In the direction of cash flow:

- the receipt of money is considered a positive flow of money;

- spending money acts as a negative flow of money.

By volume calculation method:

- gross cash flow - all cash flows in their totality;

- net cash flow (NPF) is the difference between income and expense financial flows in the period under study. It is a key result of the company's functioning, largely determines the financial balance and the rate of increase in the company's market price.

By the level of sufficiency:

- excessive - cash flow, during which the amount of money receipts is much greater than the actual need of the company for their intended use;

- scarce - cash flow, during which income is much less than the actual needs of the company for their intended use.

Estimated over time:

- present;

- future.

By the continuity of formation in the period under review:

- discrete cash flow - income or expense due to the conduct of one-time economic transactions of the company in the studied period of time;

- regular - income income or expenditure use of money for various economic transactions performed in the studied time period continuously for separate time intervals of such a period.

By the stability of time intervals:

- with the same time intervals within the studied period - annuity (interest calculated on the same date on loan obligations);

- with different time intervals within the studied period (lease payments).

The magnitude of cash flows: how to calculate

The total cash flow of the company is determined by the formula NPD \u003d NPD (NPD) + NPD (IND) + NPD (FD), where

- NPD (NPD) - net cash flow related to the operating direction;

- NPP (IND) - the value of NPP related to the investment direction;

- NPP (FD) - the value of NPP related to the financial direction.

Due to the fact that the main activity of the company is the main source of profit, it is clear that the main source of income is the NPD (OPD).

Investment activity is usually conditioned mainly by the short-term outflow of financial resources necessary for the purchase of equipment, know-how, etc. At the same time, for this type of activity there is also an inflow of money in the form of receiving dividends and interest from long-term securities, etc.

To carry out the analysis, we will calculate the cash flow in the investment direction according to the formula ChDP (IND) \u003d V (OS) + V (NMAK) + V (DFV) + V (AKV) + DVDP - OSPR + + DNKS - NMACP - DPAP - AKVP where

- В (OS) - proceeds from fixed assets;

- В (НМАК) - proceeds from the sale of the company's intangible assets;

- B (DFV) - receipts from the sale of long-term financial assets of the enterprise;

- B (AKV) - income received by the company for the sale of previously purchased shares of the company;

- ДВДП - dividend and interest payments of the enterprise;

- OSPR - the total amount of acquired fixed assets;

- ANKS - dynamics of the balance of work in progress;

- NMAKP - the volume of purchases of intangible assets;

- DFAP - the volume of purchases of long-term financial assets;

- AKVP - the total amount of the repurchased own shares of the company.

Net cash flow in the financial area of \u200b\u200bactivity characterizes income receipts and use of funds in the field of external engagement.

To find out the net cash flow, the formula is used as follows: NPP (FD) \u003d PRSK + DKZ + KKZ + BCF - PLDKR - PLKKZ - DVDV, where

- PRSK - additional external financing (financial receipts from the issue of shares and other equity instruments, additional investments of the company's owners);

- ДКЗ - the total indicator of additionally attracted long-term credit resources;

- KKZ - the total indicator of additionally attracted short-term credit resources;

- BCF - total receipts in the form of irrevocable targeted financing of the company;

- PLDKR - total payments of the main part of the debt for existing long-term loan obligations;

- ПЛККЗ - total payments of the main part of the debt on the available short-term credit obligations;

- DVDV - dividends for the company's shareholders.

Why do you need a cash flow estimate

The primary task of a detailed analysis of money flows is to find sources of surplus (lack) of financial resources, to determine their sources and methods of spending.

Based on the results of studying cash flows, you can get answers to such important questions:

- What is the volume, what sources of income and what are the main directions of their use?

- Can the company, during its operating activities, achieve a situation where the income cash flow exceeds the expenditure one, and to what extent is such an excess considered stable?

- Can the company pay off its current obligations?

- Will the profit received by the company be enough to satisfy its current monetary need?

- Will the company have enough cash reserves for investment activity?

- How can you explain the difference between the size of a company's profit and the amount of money?

Cash flow analysis

The solvency and liquidity of the company often correspond to the company's current financial turnover. In this regard, to assess the financial condition of a company, it is required to analyze the movement of cash flows, which is carried out on the basis of reports, for the compilation of which a direct or indirect method is used.

1. An indirect method of preparing a report on the movement of money. In a report based on this methodology, it is possible to concentrate data on the company's funds, reflect the criteria available in the estimate of income and expenses and which it receives after paying for the necessary factors of production to start a new reproduction cycle. Information about the inflow of financial resources is borrowed from the balance sheet, the statement of financial results. Only certain indicators of cash flow are calculated according to the information on the actual volume:

- Depreciation.

- Income proceeds from the sale of part of their shares and bonds.

- Accrual and payment of dividends.

- Obtaining credit resources and repayment of corresponding obligations.

- Capital investments in fixed assets.

- Intangible assets.

- Financial investments of temporarily free money.

- Growth of working capital stock.

- Sale of fixed assets, intangible assets and securities.

The main advantage of the technique is that it helps to reveal the presence of mutual dependence of the financial result on the dynamics of the value of financial resources. In the course of adjusting the net profit (or net loss), it is possible to determine the actual receipt (expenditure) of money.

2. Direct method of preparing a statement of the movement of money. This technique provides for a comparison of the absolute values \u200b\u200bof income receipts and the use of financial resources. For example, income from customers will be reflected in the amounts that are on hand in various bank accounts, as well as money sent to their business partners and employees of the firm. The advantage of this approach is that it helps to assess the total amount of income and expenses, to find out the items for which the most significant cash flows of the company are generated. At the same time, this method does not allow us to identify the relationship between the final financial result and the dynamics of money in corporate accounts.

- Personal capital: how to save your money so as not to lose everything

What does the cash flow budget include and where to get the data for compilation

Dmitry Ryabykh, General Director of the Alt-Invest group of companies, Moscow

The cash flow budget consists of three blocks:

- "Operating activity" (everything that is related to the current activities of the company is reflected here);

- "Investment activity" (fixed investments in fixed assets and other long-term investments, income from the sale of assets);

- “Financing activities” (accounting for receipts and payments related to financing, except for interest on loans, which are traditionally referred to as operating flows).

What conclusions can be drawn from the data in the table? In May, the budget is balanced, and cash balances are increasing, providing either a cushion of liquidity or funds to pay for expected expenses. Also, this table will help you understand the general structure of the company's expenses. However, to make serious management decisions, you will need more detailed information. Therefore, the standard structure needs to be detailed. For example, you can display sales receipts by line of business, groups of products (services), or even individual products. You should also highlight the five to ten most significant items of current costs and constantly monitor the volume of the corresponding costs. And investments must be reflected by distributing them either by types of fixed assets, or by business areas or projects.

Practice shows that the more detailed a report is, the more often problems arise with its analysis. At some point, the numbers in each line become not stable enough and the magnitude of the deviations keeps growing. Such a model turns out to be statistically unreliable, and it is impossible to predict activity on its basis. In addition, overly detailed models are very difficult to maintain; it is also not easy to compare their data with accounting indicators. That is, working with this model is inconvenient, and its regular updating is expensive.

An evidence-based budget is best based on management accounts. However, one should not neglect the data of the financial statements - after all, they contain the most complete and up-to-date information about all the company's operations. Therefore, before developing a cash flow budget, it is necessary to determine how accurately the data in this document should correspond to the information in the financial statements. You can, for example, follow these rules.

- The cash flow budget will be based on accounting data, but it is not necessary to accurately transfer all accounting information here. This budget does not need to be as detailed as an accounting document.

- When processing accounting data, one should strive to convey the economic essence of financial transactions, neglecting insignificant details (for example, nuances related to cost allocation).

- It is necessary to achieve the coincidence of the final figures with the turnover on the company's current account. And here even the little things are important: knowing the details will allow you to control the correctness of budgeting, paying attention to mistakes in time.

Working capital forecasting. The principle of describing working capital should be determined by the planning horizon for which the budget is used.

- For short-term forecasts (several weeks, one or two months), it is better to use a direct description of payments, indicating both the amount of payments and their schedules for any income and expenses of the company. This is achieved by taking into account each transaction with a description of the expected schedule of payments for the contract and parameters of shipment or work performance.

- For long-term forecasts (for example, to build a five-year plan for the development of an organization), the payment schedule must be approximately, taking into account the expected turnover parameters.

- When preparing the annual budget, a mixed approach can be used, when some items are forecasted in full (direct method), and the bulk of payments is calculated based on turnover (indirect method).

This is the main principle of budgeting. The longer the forecast is prepared, the less it should rely on specific figures provided by financiers, and the more it should be based on approximate calculations.

Planning tax payments. In cases where the expected taxes are known (and this happens with a planning horizon of one or two months or when assessing past results), it is better to indicate their exact amounts in the budget. When planning tax deductions for a longer period, you will have to go to approximate estimates of the amounts of payments, calculating them based on approximate accounting indicators. For example, when preparing to open a new division, do not try to calculate the exact amount of taxes from the salary of each employee - especially since their amount will change throughout the year (since social taxes are reduced after the accumulated amount of payments is reached); it is sufficient to use an effective rate that will allow estimating the approximate value of payments. You must do the same when planning payments for other taxes.

What is discounting cash flows

Discounted cash flow (DCF) is the reduction of the value of future (projected) financial payments to the current moment in time. The method of discounting cash flows is based on the key economic law of diminishing value of cash, that is, in the future, money will lose its own value of cash flow in comparison with the current one. In this regard, it is necessary to select the current moment of assessment as a reference point and in the future, future cash receipts (profit / loss) should be brought to the current time. For this purpose, a discount factor is used.

This factor is calculated to bring the future cash flow to its present value by multiplying the discount factor by the payment flows. The formula for determining the coefficient: Kd \u003d 1 / (1 + r) i, where

- r is the discount rate;

- i - number of the time period.

- DCF (Discounted Cash Flow) - discounted cash flow;

- CFi (Cash Flow) - cash flow in time period I;

- r - discount rate (rate of return);

- n is the number of time periods for which cash flows appear.

The most important component in the above formula is the discount rate. It demonstrates what rate of return an investor should expect when investing in any investment project. This rate is based on a large number of factors that depend on the subject of assessment and contain an inflationary component, profitability on risk-free operations, additional profit margin for risky actions, refinancing rate, weighted average cost of capital, interest on bank deposits, etc.

- Financial analysis for a non-financier: what to look for first

Practitioner tells

Ekaterina Kalikina, Chief Financial Officer, Grant Thornton, Moscow

The forecast of cash flows from operating activities is most often based on the planned volume of product sales (but it can also be calculated based on the planned net profit). Here are the calculations to make.

Receipts of money.You can determine the amount of cash receipts in two ways.

1. Based on the planned ratio of accounts receivable. The planned amount of receipts is calculated as follows: PDSp \u003d ORpn + (ORpk Î KI) + NOpr + Av, where

- PDSp is the planned revenue from the sale of products in the planned period;

- ORpn - the planned volume of sales of products for cash;

- ORPK - the volume of sales of products on credit in the planning period;

- КИ - planned ratio of accounts receivable repayment;

- HOopr - the amount of the previously outstanding balance of accounts receivable, payable as planned;

- Av - the planned amount of cash receipts in the form of advances from buyers.

2. Based on the turnover of accounts receivable. First, you need to determine the planned receivables at the end of the planning period according to the formula DBkg \u003d 2 Î SrOBDB: 365 days Î OP - DBng, where

- DBkg - planned accounts receivable at the end of the planning period;

- SROBDB - the average annual turnover of receivables;

- OR is the planned volume of product sales;

- DBng - accounts receivable at the end of the planning year.

Then you should calculate the planned amount of cash inflows from operating activities: PDSp \u003d DBng + ORpn + ORpk - DBkg + + NOpr + Av.

Remember that the volume of cash receipts of the company from operating activities directly depends on the conditions for the provision of a trade credit by the buyer. Therefore, when forecasting cash receipts, it is necessary to take into account measures to change the credit policy of the enterprise.

Costs. You can determine the amount of cash expenditures using the formula: RDSp \u003d OZp + NDd + NPp - AOp, where

- RDSp - the planned amount of cash expenses in the framework of operating activities in the period;

- OZp - the planned amount of operating costs for the production and sale of products;

- NDd - the planned amount of taxes and fees paid from income;

- NPP is the planned amount of taxes paid out of profit;

- AOp - the planned amount of depreciation deductions from fixed assets and intangible assets.

The first indicator (OZp) is calculated as follows: OZp \u003d ∑ (PZni + OZNni) Î OPni + ∑ (ZRni Î OPni) + + OXZn, where

- ПЗni - the planned amount of direct costs for the production of a unit of production;

- OPZni - the planned total production costs per unit of production;

- OPni - the planned volume of production of specific types of products in physical terms;

- ЗРni - the planned amount of costs for the sale of a unit of production;

- ОRni - the planned volume of sales of specific types of products in kind;

- ОХЗn - the planned amount of general business costs (administrative and management costs for the company as a whole).

The calculation of the second indicator (NDd) is based on the planned volume of sales of certain types of products and the corresponding rates of value added tax, excise and other similar fees. The payment schedule is drawn up on the basis of the established due dates for the payment of tax deductions.

The third indicator (NPP) can be calculated as follows: NPP \u003d (EPP Î NP) + PNP, where

- VPP - the planned amount of the gross profit of the enterprise, which is provided by operating activities;

- NP - income tax rate (in%);

- PNPP - the sum of other taxes and fees paid by the organization in the relevant period at the expense of profit.

Optimizing cash flows

To optimize the cash flow of the project, the company strives to achieve a balance between income and expense. Deficit and excess cash flows negatively affect the financial results of the company.

The negative results of the deficit are expressed in a decrease in liquidity and the level of the company's solvency, an increase in the proportion of delinquencies in loan payments, non-compliance with the deadlines for the transfer of salaries (with a concomitant decrease in employee productivity), an increase in the duration of the financial cycle, and as a result - in a decrease in the profitability of spending equity capital and company assets.

The minus of the excess is the loss of the actual value of unused financial resources for some time during inflation, the loss of possible income from the unused share of financial assets in the area of \u200b\u200btheir short-term investment, which ultimately also negatively affects the degree of profitability of assets and negatively affects the company's equity and cash flow.

Reducing the level of payments of financial resources in the short term can be achieved:

- By using float to slow down the collection of your payment documents.

- By increasing, within the framework of agreement with suppliers, the time interval for which a consumer loan is provided.

- By replacing the purchase of long-term assets, involving renewal, with their lease (use of leasing); in the course of restructuring the portfolio of their credit obligations through the transfer of their short-term part to the long-term one.

The system of acceleration (or deceleration) of the payment turnover as a result of solving the problem of balancing the deficit flow of money in the short term (and, consequently, increasing the indicator of the company's full paying capacity) raises separate questions related to the shortage that the cash flow has in future periods. In this regard, simultaneously with the activation of the mechanism of such a system, measures should be developed to ensure the balance of such a flow in the long term.

An increase in the volume of money receipts within the framework of the implementation of the company's strategy can be achieved by:

- attracting key investors to increase the amount of equity capital;

- additional issue of shares;

- attracted long-term loans;

- implementation of individual (or all) financial instruments for subsequent investment;

- sale (or lease) of unused fixed assets.

It will be possible to reduce the amount of money outflow in the long term by using such actions.

- Reducing the volume and list of ongoing investment projects.

- Stop spending money on capital investments.

- Reducing the amount of fixed costs of the company.

To optimize positive cash flow, you need to take advantage of several ways due to the increased investment activity of the company. To do this, perform the following actions:

- Expanded reproduction of non-current assets for operating activities is increased in volume.

- Provide an accelerated formation of an investment project and an earlier start of its implementation.

- Diversification of the company's current activities at the regional level.

- Actively form a portfolio of financial investments.

- Long-term financial loans are repaid ahead of schedule.

In a unified system for optimizing the company's financial flows, a special place is given to ensuring balance in time intervals, which is due to the imbalance of opposite flows and leads to some economic difficulties for the company.

The result of such an imbalance, even in the case of a high level of NPV formation, is low liquidity, which differs in cash flow (as a result, a low indicator of the company's full paying capacity) at various intervals. In the case of a rather long duration of such periods, the company faces a real danger of becoming bankrupt.

In the course of optimizing cash flows, companies group them according to different criteria.

- According to the level of "neutralization" (a concept that means that a specific type of cash flow is ready to change over time), cash flows are divided into those that can be changed and those that cannot be changed. The first type of money flow is considered to be lease payments - a cash flow, the period of which can be set as part of the agreement of the parties. The second type of financial flow is considered to be taxes and fees, which should not be received out of time.

- According to the level of predictability - all cash flows are divided into incompletely and completely predictable (completely unpredictable money flows in the general system of their optimization are not studied).

The object of optimization is the expected cash flows that may change in the time interval. In the course of their optimization, two techniques are used - alignment and synchronization.

Alignment is designed to smooth out the volumes of financial flows within the intervals of the studied time period. This optimization technique helps to some extent eliminate seasonal and cyclical fluctuations that affect cash flow, while allowing you to optimize the average balances of financial resources and increase liquidity. To evaluate the results of such a methodology for optimizing cash flows, it is necessary to calculate the value of the standard deviation or the coefficient of variation, which will decrease in the course of competent optimization.

Synchronization of money flows is based on the covariance of two types. During synchronization, an increase in the level of correlation between these two flow options should be ensured. This method of cash flows can be assessed by calculating the correlation coefficient, which will tend to the "+1" mark during optimization.

The correlation coefficient of the receipt and expenditure of money in time KKdp can be determined as follows:

- R p.o - expected probabilities of deviation of financial flows from their average indicator in the forecast period;

- ПДПi - separate values \u200b\u200brelated to income cash flow in separate periods of time of the forecast period;

- RAP is the average income cash flow in one time interval of the forecast period;

- ОДПi - individual values \u200b\u200brelated to the expenditure cash flow in separate time intervals of the forecast period;

- ОДП - the average value of the expenditure financial flow in one time interval of the forecast period;

- qПДП, qОДП - the standard deviation of the sums of income and expenditure financial flows, respectively.

The final stage of optimization is the observance of all maximization conditions for the company's NPP. If such a cash flow is increased, it will help to ensure an increase in the rate of financial development of the company within the framework of the principles of self-sufficiency, reduce the level of dependence of this development option on attracting external sources of obtaining money, and help ensure an increase in the total market price of the company.

Copying material without approval is permissible if there is a dofollow link to this page

A number of simple ratios are used to estimate cash flows and specialized complex indicators,which include the following.

1. Moment and interval multipliers,reflecting the financial results of the enterprise and defined as the ratio of the enterprise share price to a number of final indicators of the results of activity at a particular point in time or for a period. Momentary indicators include, for example:

Price / gross income ratio;

Price-to-earnings ratio before tax;

Price / Net Profit Ratio;

The ratio of price and book value of equity.

As interval multipliersare used, for example:

Price-to-earnings ratio;

Price-to-earnings ratio;

Price-to-cash flow ratio;

Price / dividend ratio.

A. I. Samylin, E. I. ShokhinEstimation of cash flows and enterprise value // Business in the Law. 2012. No. 2. S. 264-266.

2. Indicators of profitability,eg:

Return on assets (ROA) -is defined as the ratio of net profit to the amount of assets;

Return on investment (ROf) -calculated as the return (the amount of income received, net profit) on the invested capital;

Return on Equity (ROE)- is calculated as the ratio of net profit to the company's share capital.

3. Capitalization methodexists in two modifications:

Direct capitalization, according to which the cost is

acceptance is defined as the ratio of net annual income,

which the company receives, to the capitalization rate, races

calculated by equity;

Mixed investments when the value of the enterprise is determined

it is calculated as the ratio of the net annual income that the company receives to the total capitalization rate, which is determined by the weighted average value of the cost of equity and debt capital.

4. Cost estimation models based on profit indicators,in

number using:

The indicator of profit before interest, taxes and depreciation deductions - EBITDA,allowing to determine the profit of an enterprise from its main activity and compare it with a similar indicator of other enterprises;

Operating profit before interest and taxes - EBIT (Earnings before interest and taxes),net operating income net of adjusted taxes - NOPLAT (Net operating profit less adjusted tax)and net operating income before interest expense - NOPAT (Net operating profit after tax).The following indicator calculation scheme is possible:

Revenue - Expenses from ordinary activities \u003d EBIT- Tax(Adjusted Income Tax) \u003d NOPLAT.

The income tax used in the calculation is called adjusted when there are differences between the financial and tax reporting of the enterprise. The current income tax in the income statement and the amount of income tax calculated to be paid to the budget on the basis of a tax return, as a rule, have different meanings. Indicators NOPLAT"and MZ / MTS are linked to the calculation of the value of economic value added EVA(English - economic value ° dded).If, when calculating the value NOPLAT dataare taken from tax statements, then the value of income tax is taken from the financial statements.

acceptance when used as an information base

enterprise reporting:

using cash flow metrics such as FCF (f ree cas ^ A ow ~ free cash flow), ECF (eauity cashflow- cash flows to shareholders).This group of indicators operates in terms of discounted cash flows. In this case, the discount rate is calculated for the indicator ECFby model SARM,and to calculate the indicator FCFis often assumed to be equal to the weighted average price of capital WACC.As a result of calculating the indicator FCFthe cash flow available to the shareholders and creditors of the company is recorded, and the indicator ECF -cash flow available to shareholders after debt settlement; "using indicators NPV (English net present value - net present value)and APV(eng. adjusted present value- adjusted present value).This group of indicators is used, for example, in the case when an enterprise can be presented as a set of parts, each of which can be evaluated as an independent investment project. In the presence of one-time or distributed over time investments, the company uses the indicator NPV.NPV is the net cash flow, defined as the difference between cash inflows and outflows, adjusted to the current point in time. It characterizes the amount of money that an investor can receive after the proceeds pay off the investments and payments. Difference in indicator calculation APVfrom the calculation of the indicator NPVconsists in using the effect of "tax protection";

on the basis of combining income and expenses - model EVO (Edwards - Bell - Ohlson valuation model).In this case, the advantages of cost and income approaches are used. The value of an enterprise is calculated using the present value of its net assets and a discounted flow, defined as the deviation of the amount of profit from its average value for the industry;

based on the concept of residual income using indicators EVA(eng. economic value added - economic value added), MVA(eng. market value added - market value added

given cost)and CVA(eng. cash value added - added value of residual cash flow).

consider the individual evaluation indicators.

1. Market value added indicator MVA allows you to value an object based on market capitalization and market value of debt. It shows the present value of current and future cash flows. Index MVAis calculated as the difference between the market price of capital and the amount of capital attracted by the enterprise in the form of investments. The higher the value of this indicator, the higher the performance of the enterprise is assessed. The disadvantage of the "indicator is that it does not take into account intermediate returns to shareholders and the opportunity cost of capital invested.

2. Index SVA(English - shareholder value added) is called a measure of calculating value based on shareholder value added. It is calculated as the difference between the value of the share capital before and after the transaction. When calculating this indicator, it is assumed that the added value for shareholders is created in the case when the value of the return on investment capital R01Cmore than the weighted average cost of capital raised WACC.This will only last during the period when the company is actively using its competitive advantages. As soon as competition in this area increases, LO / C decreases, the gap between ROICand WACCbecomes insignificant and the creation of “shareholder” added value ceases.

There is another definition SVA -it is the increment between the calculated and book value of the share capital. The disadvantage of this method is the difficulty in predicting cash flows. The expression for calculating the cost is:

Enterprise value \u003d Market value of invested

capital at the beginning of the period + Amount SVAforecast period +

The market value of assets of non-conducting activities.

3. Total shareholder return TSR(English -

total shareholders return)

characterizes the overall effect of investment

shareholder income in the form of dividends, accruals or

decrease in cash flows of the enterprise due to growth or decrease

the price of shares for a certain period. It determines the income for

the period of ownership of the company's shares and is calculated as

the difference in the price of the company's shares at the end and beginning of the analysis

of the period under consideration to the share price at the beginning of the period. The flaw is given

This indicator is that it does not allow for taking into account the risk,

investment-related, calculated as a relative

form and determines the percentage of return on invested capital, and not

the refundable amount itself, etc.

4. Cash flow indicatordetermined by the return on investment 1 f 0 wan capital CFROI (eng.- cash flow return on investment)as the ratio of the adjusted cash inflow at current prices to the adjusted cash outflow at current prices. The advantage of the indicator is that it is adjusted for inflation, since the calculation is based on indicators expressed in current prices. In the case when the value of the indicator is greater than the value set by the investors, the company generates cash flows, and if not, then the value of the company decreases. The disadvantage is that the result is presented as a relative measure and not as a sum of value.

5. Index CVA(English - cash value added), otherwise called indicator RCF(English - residual cash flow), created in accordance with

The concept of residual income and is defined as the difference between operating cash flow and the product of the weighted average cost of capital by the adjusted total assets. Unlike the indicator CFROI,this indicator takes into account the value WACC,and the adjustments are similar to those used to calculate the indicator EVA.

6. Balanced Scorecard Bsc(English - balanced

scorecard)was developed by D. Norton and R. Kaplan. The purpose of the sis

Topics Bscis the achievement of the goals set by the enterprise

and taking into account financial and non-financial factors for this. At the heart of

system lies "the desire to take into account the interests of shareholders, buyers

lei, lenders and other business partners.

System Bscarose as a result of the need to take into account in the assessment of business "non-financial indicators and the desire to take into account indicators that are not included in the financial statements. The purpose of its application is to get answers to a number of questions, including: how do customers, partners and government bodies evaluate the enterprise, what are its competitive advantages, what is the volume and efficiency of innovation, what is the return on staff training and the implementation of corporate policy in the social life of the team?

For effective business management in this case, it is necessary to define values, objectives and a strategy acceptable to shareholders, debtors and creditors, and develop methods for quantifying these interests. As these issues are resolved, the system Bscwill become an important tool for managing cash flows.

7. Economic indicatoradded value EVA(English -

economic value added)used when it is difficult to determine

Cash flows of the enterprise for the future. It is based on

|

Index EVAcan be used to evaluate the enterprise as a whole and to evaluate its individual objects.

The main goal of any enterprise is to make a profit. In the future, the profit indicator is reflected in a special tax report on financial results - it is he who indicates how effective the enterprise is. However, in reality, the profit only partially reflects the results of the company's work and may not at all give an idea of \u200b\u200bhow much money the business is actually making. Full information on this issue can be found only from the cash flow statement.

Net income cannot reflect funds received in real terms - amounts on paper and in a company's bank account are two different things. For the most part, the data in the report are not always factual and are often purely nominal. For example, a revaluation of exchange rate differences or depreciation deductions do not bring real money, and the funds for the sold product appear as profit, even if the money has not actually been received from the buyer of the product.

It is also important that the company spends part of the profit to finance its current activities, namely the construction of new factory buildings, workshops, retail outlets - in some cases, such expenses significantly exceed the company's net profit. As a result of all this, the overall picture can be quite favorable and in terms of net profit the enterprise can be quite successful - but in fact the company will suffer serious losses and not receive the profit that is indicated on the paper.

Free cash flow helps to make a correct assessment of the company's profitability and assess the real level of earnings (as well as better assess the possibilities of a future investor). Cash flow can be defined as the funds available to the company after all due expenses have been paid, or as funds that can be taken out of the business without compromising the latter. You can get data for calculating cash flows from the company's report under RAS or IFRS.

Cash flow types

There are three types of cash flows, and each option has its own characteristics and calculation procedure. Free cash flow is:

from operating activities - shows the amount of money that the firm receives from the main activity. This indicator includes: depreciation (with a minus sign, although the funds are not actually spent), changes in receivables and credit debts, as well as warehouse stocks - and in addition other liabilities and assets, if any. The result is usually displayed in the column “Net cash from core / operating activities”. Legend: Cash Flow from operating activities, CFO or Operating Cash Flow, OCF. In addition, the same value is denoted simply by cash flow Cash Flow;

from investment activities - illustrates the cash flow aimed at developing and maintaining current activities. For example, this includes the modernization / purchase of equipment, workshops or buildings - therefore, for example, banks usually do not have this item. In English, this graph is usually called Capital Expenditures (capital expenditures, CAPEX), and investments can include not only investments "in themselves", but also be directed to the purchase of assets of other companies, such as stocks or bonds. Indicated as Cash Flows from investing activities, CFI;

from financial activities - allows you to analyze the turnover of financial receipts for all transactions, such as receiving or returning debt, paying dividends, issuing or repurchasing shares. Those. this column reflects how the company does business. A negative value for debts (Net Borrowings) means their repayment by the company, a negative value for shares (Sale / Purchase of Stock) means their purchase. Both that, and another characterize the company from the good side. In foreign reporting: Cash Flows from financing activities, CFF

Separately, you can dwell on promotions. How is their value determined? Through three components: depending on their number, the company's real profits and market sentiments in relation to it. An additional issue of shares leads to a fall in the price of each of them, since the number of shares increased, and the company's results during the time of issue most likely did not change or changed insignificantly. And vice versa - if a company buys back its shares, then their value will be distributed among a new (smaller) number of securities and the price of each of them will rise. Conventionally, if there were 100,000 shares at a price of $ 50 per share and the company bought back 10,000, then the remaining 90,000 shares should cost approximately $ 55.5. But the market is the market - the revaluation may not occur immediately or by other values \u200b\u200b(for example, an article in a major publication about such a company's policy may cause its shares to grow by tens of percent).

The debt situation is ambiguous. On the one hand, it is good when a company reduces its debt. On the other hand, well-spent credit funds can bring a company to a new level - the main thing is that there are not too many debts. For example, the well-known company Magnit, which has been actively growing for several years in a row, had a positive free cash flow only in 2014. The reason is development through loans. Perhaps, when researching, it is worth choosing for yourself some kind of maximum debt limit, when the risks of bankruptcy begin to outweigh the risk of successful development.

When all three indicators are summed up, net cash flow - Net Cash Flow ... Those. it is the difference between the inflow (receipt) of money to the company and their outflow (expenditure) in a certain period. If we are talking about negative free cash flow, then it is indicated in parentheses and says that the company is losing money, not earning it. At the same time, to find out the dynamics, it is better to compare the annual, rather than quarterly, indicators of the company in order to avoid the seasonal factor.

How are cash flows used to value companies?

You don't have to count Net Cash Flow to get an impression of a company. The amount of free cash flow also allows you to perform a business valuation using two approaches:

based on the value of the company, taking into account equity and borrowed (loan) capital;

taking into account only equity capital.

In the first case, all cash flows reproduced by existing sources of borrowed or equity funds are discounted. In this case, the discount rate is taken as the cost of capital raised (WACC).

The second option involves calculating the value of not the entire company, but only its small part - equity. To this end, the FCFE's equity is discounted after all of the company's debts have been paid. Let's consider these approaches in more detail.

Free Cash Flow to Equity - FCFE

FCFE (free cash flow to equity) is a designation of the amount of money left over from the profit received after taxes, all debts and operating expenses of the enterprise. The indicator is calculated taking into account the company's net profit (Net Income), depreciation is added to this figure. Thereafter, capital costs (arising from upgrades and / or the purchase of new equipment) are deducted. The final formula for calculating the indicator, determined after the payment of loans and registration of loans, is as follows:

FCFE \u003d Net cash flow from operating activities - Capital expenditures - Repayment of loans + Registration of new loans

Free cash flow of the company - FCFF

FCFF (free cash flow to firm) means funds that remain after the payment of tax amounts and deduction of capital expenditures, but before payments of interest and total debt are made. To calculate the indicator, you must use the formula:

FCFF \u003d Net Cash Flow from Operating Activities - Capital Expenditure

Consequently, FCFF, unlike FCFE, is calculated without taking into account all loans and issued loans. This is what is usually meant by free cash flow (FCF). As we have noted, cash flows may well be negative.

Example of calculating cash flows

In order to independently calculate cash flows for any company, you need to use its financial statements. For example, the Gazprom company has it here: http://www.gazprom.ru/investors. We follow the link and select the sub-item “all reporting” at the bottom of the page, where you can see reports from 1998. We find the required year (let it be 2016) and go to the section “Consolidated financial statements of IFRS”. Below is an excerpt from the report:

1. Let's calculate the free cash flow for capital.

FCFE \u003d 1,571,323 - 1,369,052 - 653,092 - 110,291 + 548,623 + 124,783 \u003d 112,294 million rubles remained at the disposal of the company after taxes, all debts and capital expenditures (costs).

2. Let's define the free cash flow of the company.

FCFF \u003d 1,571,323 - 1,369,052 \u003d 202,271 million rubles - this indicator shows the amount minus taxes and capital expenditures, but before payments on interest and total debt.

P.S. In the case of American companies, all data can usually be found at https://finance.yahoo.com. For example, here is the data of the Yahoo company itself in the "Financials" tab:

Conclusion

In general terms, the cash flow can be understood as the company's free funds and can be calculated both taking into account the borrowed and loaned capital, and without it. A positive cash flow for a company indicates a profitable business, especially if it grows from year to year. Nevertheless, any growth cannot be infinite and rests against natural limitations. In turn, even stable companies (Lenta, Magnit) may have negative cash flow - it is usually based on large loans and capital costs, which, if used correctly, can, however, give significant future profits.

Dividing the company's market capitalization by the firm's free cash flow, we get p / FCF ratio ... Market Cap is not hard to find on yahoo or morningstar. A reading of less than 20 usually indicates good business, although any metric should be compared with competitors and, if possible, with the industry as a whole.

Let's analyze the types of cash flows of the enterprise: the economic meaning of the indicators - net cash flow (NCF) and free cash flow, their construction formula and practical examples of calculation.

Net cash flow. Economic meaning

Net cash flow (englishNetCashFlow,NetValue,NCF, present value) - is a key indicator of investment analysis and shows the difference between positive and negative cash flow for a selected period of time. This indicator determines the financial condition of the enterprise and the ability of the enterprise to increase its value and investment attractiveness. Net cash flow is the sum of the cash flows from the operating, financing and investing activities of an entity.

Consumers of the net cash flow indicator

Net cash flow is used by investors, owners and creditors to assess the effectiveness of investments in an investment project / enterprise. The value of the indicator of net cash flow is used in assessing the value of an enterprise or an investment project. Since investment projects can have a long implementation period, then all future cash flows lead to the value at the present time (discounted), the result is NPV ( NetPresentValue). If the project is short-term, then discounting can be neglected when calculating the project cost based on cash flows.

Assessment of NCF indicator values

The higher the value of the net cash flow, the more investment attractive the project is in the eyes of the investor and lender.

Formula for calculating net cash flow

Let's consider two formulas for calculating net cash flow. So the net cash flow is calculated as the sum of all cash flows and outflows of the enterprise. And the general formula can be represented as:

NCF - net cash flow;

CI (Cash Inflow) - incoming cash flow with a positive sign;

CO (Cash outflow) - outgoing cash flow with a negative sign;

n is the number of periods for evaluating cash flows.

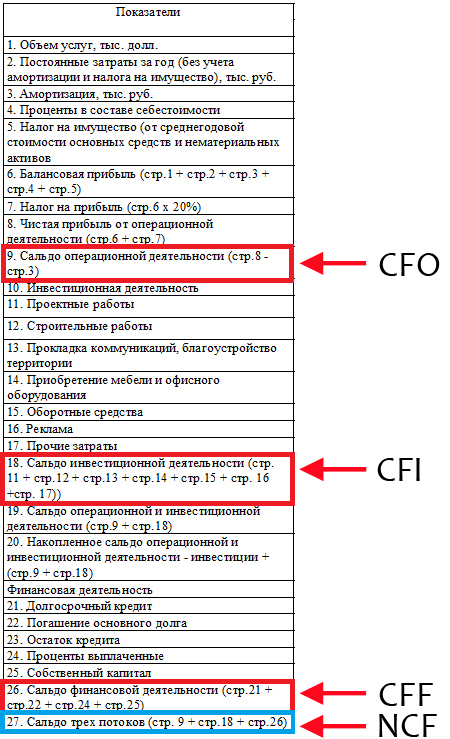

Let us describe in more detail the net cash flow by type of activity of the enterprise, as a result, the formula will take the following form:

![]() where:

where:

NCF - net cash flow;

CFO - cash flow from operating activities;

CFF - cash flow from financial activities;

Example of calculating net cash flow

Let's analyze in practice an example of calculating net cash flow. The figure below shows how cash flows are generated from operating activities, finance and investment.

Types of enterprise cash flows

All cash flows of the company that form the net cash flow can be divided into several groups. So, depending on the purpose of use by the appraiser, the following types of enterprise cash flows are distinguished:

- FCFF - free cash flow of the firm (assets). Used in investor and lender valuation models;

- FCFE is free cash flow from capital. It is used in models of valuation by shareholders and owners of the enterprise.

Free cash flow of the company and capital FCFF, FCFE

A. Damodaran distinguishes two types of free cash flows of an enterprise:

- Free cash flow of the company (FreeCashFlowtoFirm,FCFF,FCF) - the cash flow of the enterprise from its operating activities, excluding investments in fixed assets. Free cash flow of a firm is often referred to simply as free cash flow, i.e. FCF \u003d FCFF. This type of cash flow shows: how much cash remains with the company after investing in capital assets. This flow is created by the assets of the enterprise and therefore in practice it is called free cash flow from assets. FCFF is used by the company's investors.

- Free cash flow to equity (FreeCashFlowtoEquity,FCFE) - the company's cash flow only from the company's equity capital. This cash flow is usually used by the shareholders of the company.

Firm free cash flow (FCFF) is used to estimate the value of an enterprise, while free cash flow on capital (FCFE) is used to estimate shareholder value. The main difference is that FCFF estimates all cash flows of both equity and debt capital, while FCFE estimates cash flows from equity only.

The formula for calculating the free cash flow of a company (FCFF)

EBIT ( Earnings Before Interest and Taxes) – profit before taxes and interest;

СNWC ( Change in Net Working Capital) - change in working capital, money spent on the acquisition of new assets;

Capital Expenditure) .

J. English (2001) suggests a variation of the firm's free cash flow formula, which looks like this:

CFO ( CashFlow from Operations) - cash flow from operating activities of the enterprise;

Interest expensive - interest expenses;

Tax - the percentage rate of income tax;

CFI - cash flow from investment activities.

The formula for calculating the free cash flow from capital (FCFE)

The formula for estimating the free cash flow of capital is as follows:

NI ( Net Income) - the net profit of the enterprise;

DA - amortization of tangible and intangible assets;

∆WCR is net capital cost, also called Capex ( Capital Expenditure);

Investment - the amount of investments being made;

Net borrowing - the difference between repaid and received loans.

The use of cash flows in various methods of evaluating an investment project

Cash flows are used in investment analysis to assess various performance indicators of a project. Consider the main three groups of methods that are based on any type of cash flow (CF):

- Statistical methods for evaluating investment projects

- Payback period of the investment project (PP,PaybackPeriod)

- Investment project profitability (ARR, Accounting Rate of Return)

- Present value ( NV,NetValue)

- Dynamic methods for evaluating investment projects

- Net present value (NPV,NetPresentValue)

- Internal rate of return ( IRR, Internal Rate of Return)

- Profitability index (PI, Profitability index)

- Equivalent annual annuity (NUS, Net Uniform Series)

- Net rate of return ( NRR, Net Rate of Return)

- Net future value ( NFV,NetFutureValue)

- Discounted payback period (DPP,DiscountedPayback Period)

- Methods that take into account discounting and reinvestment

- Modified net rate of return ( MNPV, Modified Net Rate of Return)

- Modified rate of return ( MIRR, Modified Internal Rate of Return)

- Modified net present value ( MNPV,ModifiedPresentValue)

All of these models for assessing project performance are based on cash flows, on the basis of which conclusions are drawn about the degree of project effectiveness. As a rule, investors use the free cash flows of the firm (assets) to estimate these ratios. The inclusion in the formulas for calculating free cash flows from equity capital allows us to focus on assessing the attractiveness of a project / enterprise for shareholders.

Summary

In this article, we examined the economic meaning of net cash flow (NCF), showed that this indicator allows us to judge the degree of investment attractiveness of the project. We considered various approaches to calculating free cash flows, which allows us to focus on the assessment, both for investors and shareholders of the enterprise. Improve the accuracy of investment project appraisals, Ivan Zhdanov was with you.