Many accountants are familiar with this problem when input VAT creeps into a document from quarter to quarter, despite the fact that it was already accepted for deduction a long time ago.

Let's look at how to detect a “stuck” VAT, and, most importantly, how to correct the error, as well as:

- reasons for the appearance of “stuck” incoming VAT;

- generation of reports in 1C to identify “stuck” VAT;

- error correction methods.

1C provides a separate system of VAT registers, so it is often difficult for an accountant to deal with “stuck” incoming VAT on a supplier’s invoice from previous periods. This is especially important when accounting in the program is carried out with errors.

In this article, we will go in great detail, step by step, all the way from understanding the algorithm of the program in terms of incoming VAT, finding errors and offering ways to correct “stuck” VAT.

Error stuck incoming VAT

Often, an accountant believes that in order for VAT to be deducted, it is enough to make a posting in 1C Dt 68.02 Kt 19 and it does not matter how it is done. For example, these could be:

- manual postings for VAT in the document Manual entry ;

- manual adjustment of VAT entries in documents.

It is the movements in the VAT accumulation registers, and not in the accounting accounts, that form the entries in the purchase book and in the sales book, as well as data for the VAT declaration.

Therefore, to analyze errors associated with the VAT presented by the supplier, we will monitor the movements of the VAT presented register.

Accounting for input VAT presented by the supplier

To understand the mistake made, let’s first pay attention to the document Receipt (act, invoice) .

Postings according to the document

The document generates transactions:

- Dt 19.03 Kt 60.01 – acceptance for accounting of input VAT presented by the supplier.

The document also forms the movement according to the VAT register.

- register VAT presented – record type of movement Coming. This is a potential entry in the purchase book. She is waiting for all conditions to be met for the right to accept VAT as a deduction in the program.

Scheme for generating VAT transactions upon receipt of goods.

VAT write-off

As a result, transactions for writing off VAT were generated only in the accounting register.

Scheme for generating transactions when writing off VAT manually.

In 1C, to reflect the acceptance of VAT for deduction, two parallel entries are made in the VAT registers:

- Consumption by register VAT presented ;

- register entry Book of purchases .

Document Manual entry does not automatically generate such entries in registers, therefore, as a result, incoming VAT “hangs” in the register VAT presented .

Stuck VAT error

When autofilling a document Generating purchase ledger entries the program includes such VAT for deduction, because tries to automatically swipe Consumption VAT by register.

Determining the amount of stuck incoming VAT

In order to correct errors associated with “stuck” VAT, you must first determine for which invoices and in what amounts the incoming VAT is “stuck” in the program.

To do this, we suggest using the report Express check .

Express check

Step-by-step instructions for determining a “stuck” VAT report Express check .

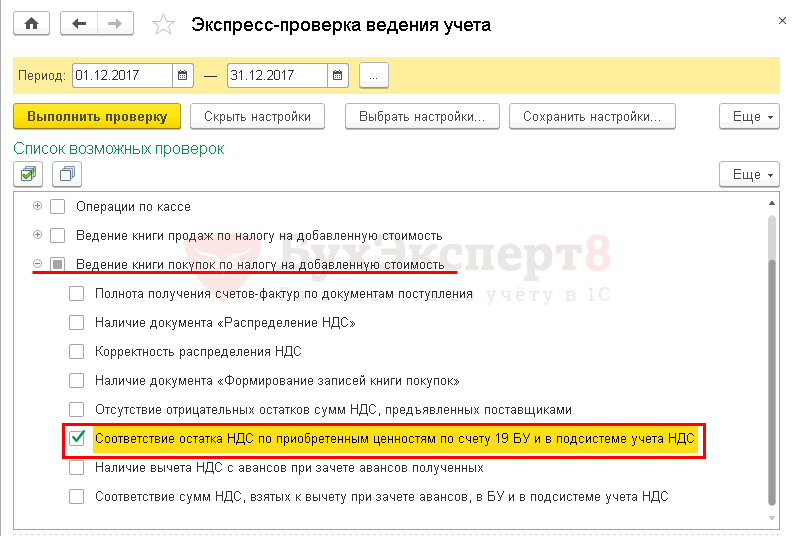

Step 1: Open the report Express check : chapter Reports – Accounting analysis – Express check.

Step 2. Complete the settings to search for “stuck” VAT: button Show settings – List of possible checks – Maintaining a book of purchases for value added tax – checkbox Correspondence of the VAT balance on purchased values in account 19 BU and in the VAT accounting subsystem.

Step 3. Generate a report using a button Run check .

Other reports to identify stuck VAT

To identify “stuck” VAT, you can also use the setting of the Universal report Checking “stuck” VAT. But the downside is that it does not provide a breakdown of the invoices for which the incoming VAT is stuck.

Fixing a bug with stuck VAT

We will show you how to make a correction in 1C if a “stuck” VAT is identified in the NU register.

Manually writing off incoming VAT

To write off incoming VAT by register VAT presented let's use the document Manual entry .

Step 1: Create a new document Manual entry : chapter Operations – Accounting – Manually entered transactions – Create button – Operation.

Open the VAT register selection form using the button MORE – Register selection.

Step 2. On the tab Accumulation registers check the box VAT presented .

Step 3: Go to the tab VAT presented and by button Add Enter VAT write-off information.

Tab Accounting and tax accounting not filled in. The posting to write off VAT from the credit of account 19 has already been made previously. Records are generated only according to the VAT register presented.

Step 4. Save the document using the button Save and close .

Step 5. Check the document is complete Creating a purchase ledger entry - button Complete the document .

Data on the supplier invoice of Flower Arrangement LLC no longer appears in the document Generating purchase ledger entries . The fix was completed correctly.

Write-off of VAT using a specialized document

There is a special regulatory document for writing off VAT in 1C VAT write-off : chapter Operations – Closing the period – Regular VAT operations – Create button – VAT write-off.

If an accountant wants to write off VAT and not deduct it at all, then it is better to use this document. It will immediately generate a posting for writing off VAT according to accounting and write off VAT according to the register VAT presented .

The document forms the necessary movements:

- in accounting; PDF

- in the accumulation register VAT presented . PDF

VAT must be deducted

If, as a result of the audit, the entry for accepting VAT for deduction did not previously appear in the Purchase Book and was not reflected in VAT returns (Section 8), then for the possibility exercise the right to deduct VAT in document Manual entry you need to add and fill out a new tab for the accumulation register VAT Purchases .

Accepting VAT for deduction manually will look like this:

Register VAT presented .

Register VAT Purchases .

Reflection of VAT deduction in Shopping Book : chapter Reports – VAT – Purchase Book.

In Letter dated 04/06/2015 No. 03-03-06/1/19158, the Ministry of Finance confirmed that the amounts of taxes additionally assessed by inspectors during inspections can be taken into account in other expenses associated with production and sales. However, officials did not specify what taxes they had in mind. Is VAT included?

Amounts of taxes accrued by inspectors based on the results of control activities are taken into account as part of other expenses associated with production and sales. The Ministry of Finance came to this conclusion in Letter No. 03-03-06/1/19158 dated 04/06/2015. However, officials did not specify what taxes they had in mind. Does this include VAT, since the Tax Code of the Russian Federation has rules prohibiting its recognition for profit tax purposes? Let's try to answer this question based on the explanations of officials and judicial practice.

Non-payment (incomplete payment) of VAT amounts identified by the tax authority during an on-site or desk audit may arise as a result of both the organization understating the tax base (tax rate) and the unlawful use of tax deductions or their failure to restore them in cases provided for by law. Both, in principle, are regarded as the amount of additional VAT assessed by the inspectors.

We will not dwell on tax deductions in this article - this is a separate topic for discussion. In addition, amounts that, in the opinion of controllers, are included by the taxpayer in deductions in violation of tax rules, can hardly be considered accrued taxes in the sense in which they are applied in paragraphs. 1 clause 1 art. 264 Tax Code of the Russian Federation. Therefore, let’s talk about the following: is it possible to recognize, when calculating income tax, the amounts of VAT additionally assessed by inspectors due to the fact that the organization did not calculate them when selling goods (works, services) and, accordingly, at this moment (as well as after the end of the inspection) did not presented to the buyer for payment? In our opinion, this problem has several solutions.

Position of the Ministry of Finance

It is set out in Letter No. 03-03-06/2/20 dated 02/01/2011. The taxpayer (bank) contacted the financial department with such a problem. An on-site inspection was carried out against him, as a result of which inspectors revealed non-payment of VAT for 2006 - 2008. The arrears arose due to the fact that the bank did not tax transactions carried out under agency agreements for settlement and cash services in favor of third parties. Having paid off this debt in 2010, I asked: is it possible to take into account the amounts of VAT paid from one’s own funds for profit tax purposes based on paragraphs. 1 clause 1 art. 264 of the Tax Code of the Russian Federation?

It is not difficult to guess that the officials' answer was negative. The basis is the provisions of paragraph 19 of Art. 270 Tax Code of the Russian Federation. Let us recall that according to this norm, when determining the tax base, expenses in the form of tax amounts are not taken into account. presented in accordance with the Tax Code of the Russian Federation, the taxpayer to the buyer (acquirer) of goods (work, services, property rights), unless otherwise provided by the Tax Code of the Russian Federation.

What can you find fault with in these explanations of the Ministry of Finance?

Yes, the amounts of VAT that the taxpayer-seller presented for payment to his counterparties-buyers as part of the price of goods (work, services) sold are not included in expenses. And the reason for this is the indirect nature of the tax. The seller determines the amount of VAT that must be received from buyers and undertakes to transfer it to the budget, having previously reduced it by the amount of tax presented to him for payment in the cost of purchased goods (works, services).

Thus, the taxpayer does not incur actual expenses when fulfilling his VAT obligations to the budget. After all, the source of its payment is the funds of buyers, and not the taxpayer himself. True, these conclusions are valid only if the latter presents the tax to the counterparties.

It would seem that there is no alternative to this. In paragraph 1 of Art. 168 of the Tax Code of the Russian Federation says in black and white: when selling goods (work, services), the taxpayer in addition to the price (tariff) of the goods (work, services) sold must present the appropriate amount of tax for payment to the buyer of these goods (works, services). There are no exceptions to this legal requirement. That’s why, probably, in paragraph 19 of Art. 270 of the Tax Code of the Russian Federation, the presentation of VAT amounts to the counterparty is spoken of as a fait accompli, and not as an event that, with some degree of probability, is about to occur.

What happens? For taxpayers who ignored (no matter for what reason) the requirements of paragraph 1 of Art. 168 of the Tax Code of the Russian Federation, restrictions provided for in paragraphs. 1 clause 1 art. 264 of the Tax Code of the Russian Federation for the recognition of amounts of accrued taxes for tax purposes do not apply? After all, according to paragraph 19 of Art. 270 of the Tax Code of the Russian Federation cannot be taken into account in expenses only tax amounts presented to buyers. And since this has not been done, there is no reason for not including in other expenses the VAT amounts that the organization will have to contribute to the budget from its own funds. Now, if normal instead of the word "presented" was listed "subject to presentation", then it’s a different matter: taxpayers would have no reason to take into account indirect tax as part of expenses that reduce the taxable base for profit. But the law of the subjunctive mood does not tolerate. Judicial practice is an example of this.

Position of the judiciary

Let's start with the fact that in law enforcement practice on the issue under consideration, there are judicial decisions made in favor of both tax authorities and taxpayers. However, it should be noted that the latter were supported by the arbitrators in later decisions. For convenience, we present arbitration practice in tabular form.

| Indicators |

Court decisions in favor of... |

|

|---|---|---|

| ...taxpayers |

…tax authorities |

|

Details of judicial acts |

Resolutions: – AS VVO dated 05/07/2015 No. F01-942/2015 in case No. A11-4982/2014; – FAS DVO dated June 19, 2014 No. F03-2381/2014 in case No. A73-3481/2012, dated September 2, 2013 No. F03-3614/2013 in case No. A73-16254/2012 |

Resolutions: – FAS DVO dated September 15, 2011 No. F03-4073/2011 in case No. A80-276/2010; – FAS MO dated May 21, 2009 No. KA-A40/4466-09-2 in case No. A40-56737/08-33-236 |

Judges' findings |

Additional assessed by tax authorities and paid at the expense of VAT’s own funds (without presenting it for payment to buyers) subject to accounting taxpayer when calculating the taxable base for income tax |

Current tax legislation not provided inclusion of additional VAT amounts accrued during a tax audit as expenses that reduce income when calculating income tax |

Arguments of the judges |

When calculating the tax base for profit, VAT amounts received from buyers of goods (works, services) are not taken into account when determining the amount of income from sales (clause 1 of Article 248 of the Tax Code of the Russian Federation) and, as a result, are not included in expenses (clause 19 Article 270 of the Tax Code of the Russian Federation). In contrast to the stated regulation, the disputed tax amounts were not presented in addition to the cost of goods (work, services) sold and, due to this circumstance, were paid by the taxpayer at his own expense and were not reimbursed by the buyer in any other way. Thus, paragraph 19 of Art. 270 of the Tax Code of the Russian Federation is not applicable in this case, since it applies only to VAT amounts presented by the taxpayer to the buyer. Therefore, paragraphs. 1 clause 1 art. 264 of the Tax Code of the Russian Federation, which provides for the accounting of accrued tax amounts as expenses. In addition, the norms of paragraph 2 of Art. 170 of the Tax Code of the Russian Federation (which the inspectorate refers to) along with Art. 171 of the Tax Code of the Russian Federation determine the procedure for accounting not for “outgoing” but for “incoming” VAT. In paragraph 2 of Art. 170 of the Tax Code of the Russian Federation contains provisions that are an exception to the general rule about declaring this tax as a tax deduction, and not from the rule provided for in paragraph 19 of Art. 270 of the Tax Code of the Russian Federation, which is subject to application only in relation to “outgoing” VAT calculated by the taxpayer on transactions of sale of goods (works, services) |

According to paragraph 19 of Art. 270 of the Tax Code of the Russian Federation, when determining the tax base for profit, expenses in the form of taxes presented in accordance with the Tax Code of the Russian Federation by the taxpayer to the buyer (acquirer) of goods are not taken into account, if other not established by the Tax Code of the Russian Federation. Cases of attributing VAT to costs of production and sale of goods (works, services) are enshrined in Art. 170 Tax Code of the Russian Federation. Disputed amounts of VAT under the specified norm do not fall under,because they were subject to presentation of goods (works, services) to buyers. The fact that the taxpayer did not present the VAT amounts accrued based on the results of tax audits for previous periods for payment to counterparties, but contributed them to the budget at his own expense, does not mean that the provisions of clause 19 of Art. 270 Tax Code of the Russian Federation. The seller’s obligation to present to the buyer, in addition to the price (tariff) of the goods sold, the corresponding amounts of VAT is enshrined in Art. 168 Tax Code of the Russian Federation. In this case, the seller has the right collect from the buyer not paid in settlements for sold goods (works, services) amounts constituting VAT (in making this conclusion, the arbitrators of the Moscow District referred to clause 9 of the Information Letter of the Supreme Arbitration Court of the Russian Federation dated December 10, 1996 No. 9 “Review of judicial practice in the application of legislation on tax on Additional cost") |

Now let's speculate

As we can see, the stumbling block to the identified problem is the provisions of paragraph 19 of Art. 270 Tax Code of the Russian Federation. According to judges who are loyal to the persons being inspected, this norm is calculated exclusively on taxpayer-sellers and applies only in relation to the “outgoing” tax, that is, not subject to presentation to the buyer (as required by paragraph 1 of Article 168 of the Tax Code of the Russian Federation), and actually presented. In this regard, the arbitrators reject the tax authorities’ reference to clause 2 of Art. 170 of the Tax Code of the Russian Federation, which provides a closed list of cases when amounts of “input” tax are attributed to production and sales costs. According to the judges, the norms of paragraph 2 of Art. 170 of the Tax Code of the Russian Federation are not the “other” as indicated in paragraph 19 of Art. 270 Tax Code of the Russian Federation. Is it so? Let's speculate.

Let us quote the last of these norms once again: when determining the tax base, expenses are not taken into account in the form of amounts of taxes presented in accordance with this Code by the taxpayer to the buyer (acquirer) of goods (work, services, property rights), unless otherwise provided by this Code, as well as amounts of trade tax.

Indeed, what is deducted from the norm first of all is that it talks exclusively about the taxpayer-seller and only about the “outgoing” tax. But then what other cases did the legislator mean? Are there any rules in the Tax Code of the Russian Federation that allow an organization to include amounts of “outgoing” VAT as expenses? We were unable to find such norms (although there is one “loophole”, more on that later).

But what if we read the word “presented” not only in relation to the seller, but also to the buyer? Then, in our opinion, everything falls into place. After all, neither the amounts of indirect tax presented by the taxpayer-seller nor the amounts of VAT presented to the taxpayer-buyer are included in expenses. But! There is an exception to this general rule, and, we believe, one is the cases enshrined in paragraph 2 of Art. 170 Tax Code of the Russian Federation. And they concern only the “input” tax. It turns out that tax legislation does not provide for the inclusion of “output” VAT (including that accrued by inspectors based on the results of a tax audit) as an expense when calculating income tax. How do you like this interpretation of the analyzed norm? This is exactly how the courts reasoned when they sided with the inspectors.

Now regarding the actual presentation of VAT amounts to the buyer. As noted above, from the provisions of paragraph 19 of Art. 270 of the Tax Code of the Russian Federation it follows that only VAT amounts that were documented by the seller for payment to the buyer fall into the category of profits not taken into account for tax purposes.

For your information

In arbitration practice, we were able to discover a different interpretation of the provisions of this norm. Thus, in the Resolution of the FAS ZSO dated January 23, 2006 No. F04-2578/2005(18865-A27-40), F04-2578/2005(18884-A27-40) in case No. A27-21352/2004-6 it is said: in accordance from paragraph 19 of Art. 270 of the Tax Code of the Russian Federation, expenses should not include VAT, which the taxpayer presented or should have presented to the buyer when selling goods (works, services).

Judging by the decisions made in favor of taxpayers, arbitrators do not oblige the latter to present to their counterparties the amounts of VAT accrued based on the results of tax audits. Why is this happening? Perhaps the servants of Themis believe that if the tax is calculated not by the taxpayer himself at the time of sale, but by the tax authority during control activities, the provisions of paragraph 1 of Art. 168 of the Tax Code of the Russian Federation is it possible not to comply? It turns out that the organization, at its own discretion, decides when to issue additional VAT amounts assessed by inspectors for payment to the buyer, and when not to do this and transfer them to the budget at its own expense.

By the way, in cases No. A73-3481/2012 and No. A73-16254/2012 considered by the Federal Antimonopoly Service, the taxpayer did just that. Of the additional VAT assessed by the inspectors in the amount of 22 million rubles. he presented tax for payment (3 million rubles) to only one of the counterparties, and the remaining 19 million rubles. contributed to the budget at his own expense, including this amount in tax expenses. Judges based on this fact of selective application by the organization of the provisions of paragraph 1 of Art. 168 of the Tax Code of the Russian Federation did not focus attention.

Let us add: when resolving these disputes, the district arbitrators used as arguments the conclusions made by the Presidium of the Supreme Arbitration Court in Resolution No. 15047/12 dated 04/09/2013 in case No. A40-136146/11-107-569. The tax authorities considered that the reference to this judicial act incorrect. In our opinion, the controllers' claims are not unfounded. Let me explain.

The dispute considered by the senior judges concerned the attribution of VAT amounts to expenses, on one's own calculated by the taxpayer at a rate of 18% and paid by him to the budget in connection with non-confirmation of the right to apply the zero rate on export transactions. The Presidium of the Supreme Arbitration Court came to the conclusion that clause 19 of Art. 270 of the Tax Code of the Russian Federation is not applicable in this case, since the company did not present VAT for payment to contractors. This means that there is no reason for not using paragraphs. 1 clause 1 art. 264 Tax Code of the Russian Federation.

But! The fact is that the Tax Code of the Russian Federation is obliged to present VAT to foreign buyers (as opposed to Russian ones) not provided. From paragraph 9 of Art. 165 of the Tax Code of the Russian Federation, if the taxpayer shipped goods for export, but within the prescribed period did not submit to the inspection documents confirming the validity of the application of the 0% rate, then he is obliged to calculate and pay to the budget (note, at his own expense) VAT on the cost of the goods, sold for export. By the way, if a number of conditions prescribed in the Tax Code of the Russian Federation are met, these funds are subject to return to the taxpayer.

Agree, the circumstances of the cases are completely different. The only similarity is that in both cases the taxpayers bore the costs to pay taxes from your own funds. But everyone had their own reasons for this: compliance with the requirements of the law and the decisions of the tax authority based on the results of the audit. Would judges be favorable to taxpayers if they had not paid the accrued tax into the budget (after all, according to paragraph 1 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, tax amounts are taken into account in other expenses, regardless of the fact of payment)? We believe the outcome of the case would have been different.

For your information

In the Resolution of the Federal Antimonopoly Service of North Kazakhstan dated August 10, 2009 in case No. A32-5096/2007-12/27, the fact of payment of VAT contributed by the company to the budget in pursuance of the inspector’s decision was the basis for the arbitrators’ conclusion on the lawful recognition of this tax for profit tax purposes. Moreover, these amounts, the judges decided, should be taken into account in the composition non-operating expenses in accordance with paragraph 20 of Art. 265 Tax Code of the Russian Federation.

Let's sum it up

So, we have analyzed the positions of the competent and judicial authorities on the identified problem, indicating the weak and strong sides of their argumentation. Now let us present to the readers our own position on the controversial issue.

The legislation obliges taxpayers to contribute to the budget the amounts of VAT additionally assessed by the inspectorate as a result of their illegally understating the taxable base for this tax. Taxpayers do not argue with this.

Since the decision of the tax authority must be executed within a limited time frame, organizations, as a rule, repay the arrears at their own expense. This is due to the fact that failure to receive funds (and, accordingly, VAT amounts) in payment for shipped goods (works, services) does not relieve the taxpayer from the obligation to calculate and pay VAT on sales to the budget. After all, according to the general rule established by paragraphs. 1 clause 1 art. 167 of the Tax Code of the Russian Federation, the moment of determining the tax base for VAT is the day of shipment (transfer) of goods (work, services).

The Tax Code of the Russian Federation contains a rule (clause 1, clause 1, article 264), according to which the amount of calculated tax is subject to accounting as part of income tax expenses. However, since the nature of an indirect tax (and VAT is such) involves reimbursement of the taxpayer’s expenses for its payment to the budget by the buyer of goods (works, services), in paragraph 19 of Art. 270 of the Tax Code of the Russian Federation contains a provision that prohibits taking into account the amount of VAT that must be presented to customers in expenses.

But! The meaning of this prohibition, we believe, loses force in cases where the taxpayer-seller (for reasons beyond his control) either deprived of the opportunity to present the amount of VAT to its counterparty (for example, in the event of its liquidation), or actually doesn't receive there is no compensation from the latter, even if the fact of presentation of tax for payment took place. Moreover (attention!) the amount of VAT not received by the seller becomes a receivable arising from the contract and associated with payment for goods (work, services). Therefore, after the expiration of the limitation period, this debt can be taken into account by the organization for tax purposes as a loss based on the provisions of Art. 265 and 266 of the Tax Code of the Russian Federation. At the same time, the restriction on the recognition of expenses established in clause 19 of Art. 270 of the Tax Code of the Russian Federation does not prevent the writing off of doubtful debts.

note

The Ministry of Finance is not against write-offs VAT amounts as part of accounts receivable after the expiration of the limitation period (see letters dated July 24, 2013 No. 03-03-06/1/29315, dated August 3, 2010 No. 03-03-06/1/517). The Presidium of the Supreme Arbitration Court (Resolution No. 6602/05 dated November 23, 2005) is of the same opinion.

The fact that the voiced approach has a right to exist is evidenced by arbitration practice. Example - Resolution of the AS SZZ dated December 12, 2014 in case No. A42-4051/2012.

The essence of this matter is as follows. The taxpayer believed that the activities he carried out were not subject to VAT, so he issued tax-free invoices to his counterparties. The VAT amounts, of course, were not allocated and, accordingly, were not paid by the buyers in the acts of work performed.

Subsequently, the taxpayer realized that he had violated the provisions of Sec. 21 Tax Code of the Russian Federation. Therefore, he adjusted his tax obligations by filing updated returns for the relevant periods in which he calculated VAT payable. The organization contributed these amounts to the budget from its own funds.

But the taxpayer did not stop there. Guided by paragraph 1 of Art. 168 of the Tax Code of the Russian Federation, he sent notices to his counterparties about the need to pay additional VAT. The company attached corrected invoices to these notices, which were left by buyers without response and without payment. In this regard, after waiting for the statute of limitations to expire, the organization, in compliance with all the rules, wrote off receivables consisting of VAT amounts in tax accounting. And she did this, as the court considered, on completely legal grounds.

According to the controllers, clause 19 of Art. 270 of the Tax Code of the Russian Federation and in this situation prevented the recognition of VAT amounts additionally accrued by the company in expenses. The arbitrators did not agree with this approach. They decided: since the amount of tax was additionally presented to buyers in the prescribed manner, but was not paid by them, the company has the right, on the basis of clause 1 of Art. 252, pp. 2 p. 2 art. 265, paragraph 2 of Art. 266 and paragraph 1 of Art. 272 of the Tax Code of the Russian Federation, reflect the corresponding receivables as a bad debt in the expenses of the period in which its collection expired.

So, we have given several ways to recognize, for profit tax purposes, VAT amounts additionally assessed by the inspectorate based on the results of control activities and paid to the budget by the inspected person at his own expense. Which one should you prefer to avoid disputes with tax authorities? The choice is yours.

Additionally, read the article “Additional taxes were assessed during an on-site audit. How and when to take them into account in expenses?” in this issue of the magazine.

The subject of these legal proceedings were the same circumstances, established during different audits (on-site and desk) of the same taxpayer.

This judicial act is described in the article by E. G. Vesnitskaya “The Supreme Arbitration Court of the Russian Federation: VAT on unconfirmed exports - expenses of the organization” (No. 10, 2013).

According to this norm, non-operating expenses include other justified expenses.

The company operates on OSNO. When selling goods, we apply a VAT rate of 18% and 0%. Question: How to correctly write off input VAT that will not be submitted for refund? Reflection in BU and NU.

If VAT is not submitted for reimbursement, then reflect the write-off of input VAT in accounting with the following entry: Debit 91-2 “Not accepted” Credit 19 – VAT written off at the expense of the organization’s own funds.

Input VAT does not reduce the tax base for income tax (clause 1 of Article 170 of the Tax Code of the Russian Federation).

How to reflect VAT in accounting and taxation

BASIC

When calculating income tax, do not take into account the VAT amounts charged to buyers upon the sale of goods (work, services, property rights) (clause 19 of Article 270 of the Tax Code of the Russian Federation).

Input VAT will also not affect the calculation of income tax. This is due to the fact that amounts of input tax presented by Russian counterparties are accepted for deduction (clause 1 of Article 171 of the Tax Code of the Russian Federation). However, there are exceptions to this rule. In some cases, input tax amounts must be included in the cost of purchased goods (work, services, property rights). In this case, the amount of VAT will be included in expenses when reflecting the cost of goods (work, services, property rights) in tax accounting. On the possibility of including in expenses the amount of VAT (its equivalent) paid to foreign counterparties, see How to take into account other expenses related to production and sales when calculating income tax.

If the requirements of articles and

The organization combines two types of activities: OSNO and UTII. Keeps separate records of income and expenses. How to correctly write off VAT that is not accepted for deduction after the distribution of VAT on expenses, distributed depending on the revenue from the type of activity... And also not accepted for deduction due to the lack of primary documents?

Amounts of VAT related to activities subject to UTII should be taken into account in the cost of purchased goods (work, services) (Debit 08, 10, 20, 41 Credit 19).

In the absence of primary documents and (or) invoices, write off input VAT as expenses without reducing taxable profit. In this case, it is impossible to include VAT amounts in the cost of purchased goods (works, services).

In accounting, reflect the write-off of input VAT, which cannot be deducted or taken into account in the cost of purchased goods (work, services, property rights), by posting Debit 91-2 Credit 19 - VAT is written off at the expense of the organization.

If an organization applies PBU 18/02, a permanent tax liability must be reflected in accounting. Reflect it by posting Debit 99 subaccount “Fixed tax liabilities” Credit 68 subaccount “Calculations for income tax”

– a permanent tax liability is reflected from the written off amount of VAT.

Rationale

Olga Tsibizova, Head of the Indirect Taxes Department of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia

When input VAT must be included in the cost of acquired property (work, services)

Separate VAT accounting

If property (work, services, property rights) was acquired to perform both taxable and non-taxable transactions, then organize separate accounting of input VAT amounts presented by suppliers. Tax amounts related to non-taxable transactions should be taken into account in the cost of acquired property (work, services, property rights). Tax amounts related to taxable transactions are deductible.

4.1

OSNO and UTII

If an organization combines a general taxation system and UTII, then organize separate accounting of input VAT amounts presented by suppliers. Tax amounts related to activities subject to UTII should be taken into account in the cost of purchased goods (work, services). Tax amounts related to activities on the general taxation system should be deducted.

This procedure follows from paragraphs 4.1 of Article 170 of the Tax Code of the Russian Federation.

Oleg Khoroshiy, Head of the Department of Profit Taxation of Organizations of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia

How to reflect VAT in accounting and taxation

Situation: how to reflect input VAT in accounting if its amount (part of the amount) will be included in the cost of goods (work, services)

Various options are possible depending on the use of the purchased goods (works, services).

At the time of purchasing goods, works, services, VAT allocated in the invoice should be taken into account on account 19. This conclusion follows from the Instructions for the chart of accounts. There, in particular, it says that account 19 takes into account the VAT paid or payable to the supplier. Therefore, when purchasing goods, works, services (property rights), make the following entries in accounting:

Debit 10 (08, 44, 20, 26...) Credit 60 (76)

– reflects the receipt of materials, goods, works, services, etc.;

Debit 19 Credit 60 (76)

– reflects the VAT presented by the supplier.

The moment when an organization can include the cost of VAT in the composition of goods, works, services, fixed assets depends on the reason why VAT is taken into account in the cost of property (works, services). For example, if an organization uses an acquired fixed asset in two types of activities (taxable and not subject to VAT), then the input VAT, which must be included in the initial cost of the property, can only be determined at the end of the tax period (clause 9 of article 274, clause 4 Article 170 of the Tax Code of the Russian Federation). At this point, the organization will make the posting:

Debit 08 Credit 19

– input VAT is included in the initial cost of the property.

If an organization, for example, is engaged only in retail trade, transferred to UTII, then VAT can be written off from account 19 on the increase in the cost of goods on the day of their purchase.

Situation: Is it possible to take into account when calculating income tax the amount of input VAT that cannot be deducted or included in the cost of purchased goods (works, services, property rights)

No you can not.

Paragraph 1 of Article 170 of the Tax Code of the Russian Federation states that input VAT does not reduce the tax base for income tax. With the exception of input tax included in the cost of purchased goods (work, services, property rights). In this case, input VAT is taken into account when calculating income tax as part of the cost of goods (work, services, property rights). It is possible to include VAT in the cost of goods (work, services, property rights) if the requirements of paragraph 2 of Article 170 of the Tax Code of the Russian Federation are met. For more information, see

They have special rights and some opportunities that allow them to reduce the tax burden on authorities. The regulatory legal framework in the field of taxation provides for cases where taxes cannot be reimbursed or deducted. As a rule, in such a situation it is possible to write off expenses, for example, for entertainment and other types.

Possibility of such an event

VAT on non-acceptable expenses, on deferred expenses, re-invoicing of expenses without tax, write-off as expenses - all this can terrify an unprepared person. Therefore, let's try to understand the jungle of such concepts.

The Tax Code states that in order to write off VAT, a number of mandatory requirements must be met:

- must be paid, it can also be sold or returned to the seller;

- no operations were carried out according to this procedure;

- The purchase of a product can be confirmed by an entry in the purchase book or;

- the purchased product or service will be used in procedures that are not subject to VAT;

- planned abroad of Russia;

- For taxation, a special one is used.

Knowing about expenses, it is important to understand when writing off as expenses is impossible.

The video below will tell you about separate VAT accounting for indirect expenses in trade:

The impossibility of such an event

Individual entrepreneurs are often forced to change the tax regime in their activities. Before this procedure, the accounting service carries out audit activities in order to reduce material balances. In these conditions, writing off VAT on costs is impossible according to current legislation, in particular:

- VAT accepted for deduction before the change in the tax regime and after;

- You cannot multiply capitalized amounts by including VAT in them.

The procedure for writing off VAT for expenses in tax accounting is discussed below.

The video below will tell you whether travel expenses are subject to VAT and how they are reimbursed:

Procedure for writing off VAT on expenses

Mandatory actions

The goods and services that an organization purchases to carry out its activities are used in various operations. Some of them are subject to VAT, while others are not. In order to be able to write off VAT in the future, it is necessary to keep separate records of input tax. However, such a requirement is not regulated, but is a practical conclusion.

Mandatory actions when writing off VAT on expenses are:

- The cost of the purchased product must be confirmed by relevant documents.

- When an individual entrepreneur applies, then during capitalization the tax is reflected in the cost of the product.

- can be taken into account at any time or after payment for the product is made.

Writing off VAT on expenses is actually a simple procedure, since it is automated by the 1C system. The software package has a section regarding accounting policies. It is necessary to select the option of inclusion in the cost or write-off. The entered data will be shown in the invoice request. In the section that reflects inventories, you need to select accounting by batch, quantity or amount.

The entries regarding the attribution of VAT to income tax expenses are discussed below.

Postings

Product for sale

In accounting and tax accounting, in order to write off VAT on expenses, it is necessary to create transactions (where Dt is a debit, Kt is a credit) that correspond to each specific transaction if the goods are purchased for sale:

In accounting and tax accounting, in order to write off VAT on expenses, it is necessary to create transactions (where Dt is a debit, Kt is a credit) that correspond to each specific transaction if the goods are purchased for sale:

- Dt 41 Kt 19 means that VAT is included in the price of the product or service;

- Dt 60 Kt 51, 50. 71– the cost of goods and services is fully paid;

- Dt 41 Kt 60– purchased goods;

- Dt 19 Kt 60 the tax has been allocated;

- Dt 90.2 Kt 41 means that the cost is transferred to the cost price.

Products for your own activities

If products are purchased for your own activities, then the following transactions must be completed:

- Dt 20.23 Kt 10– the cost is written off as cost;

- Dt 10 Kt 19 means that VAT is included in the price of the product after payment;

- Dt 60 Kt 51– the purchased item has been paid for;

- Dt 19 Kt 76, 60– VAT is indicated in the documents of the seller from whom the goods were purchased;

- Dt 10 Kt 60– the cost is indicated at the time of posting.

Writing off VAT on expenses is not a deduction. This operation is performed in order to increase the organization’s expenses and profit margin, which is reflected in the bank account.

From this video you will learn whether and how to write off VAT as expenses under the simplified tax system: